Trade smarter, manage risk, and turn crypto opportunities into a clear, repeatable strategy for profit.

Cryptocurrency trading attracts millions of people because it offers open access to global markets, operates around the clock, and allows individuals to take control of their own financial decisions. However, while stories of quick profits often dominate headlines and social media, the reality is more balanced. Making money from crypto trading is possible, but it requires knowledge, discipline, and a clear understanding of risk. Profitable trading is not about luck or chasing trends, it is about preparation, consistency, and learning how markets behave.

This guide explains how crypto trading works, how people aim to generate profits, and what beginners should focus on before placing their first trade.

Understanding What Crypto Trading Really Is

Crypto trading involves buying and selling digital assets, such as Bitcoin or Ethereum, through a crypto trading platform or crypto trading app. The goal is to buy cryptocurrency at a lower price and sell cryptocurrency later at a higher price, or to trade price movements over shorter timeframes. Unlike traditional stock markets, crypto markets operate 24 hours a day, seven days a week, which creates frequent opportunities but also increases volatility.

There are different approaches to trading. Some traders focus on short-term price movements, opening and closing positions within hours or days. Others take a longer-term view, holding assets for weeks or months while reacting to broader market trends. Neither approach guarantees profit, but both rely on understanding price behaviour, market sentiment, and timing.

Crypto trading is not the same as gambling. While outcomes are uncertain, decisions should be based on analysis, planning, and risk control rather than emotion or impulse.

Choosing the Right Crypto Trading Platform

Before you can trade, you need access to a reliable crypto trading platform. This is where you buy crypto, sell crypto, place orders, and manage your positions. The best platform for you depends on your experience level, trading style, and goals.

Security should always come first. Look for platforms that use strong account protection, such as two-factor authentication, withdrawal whitelists, and cold storage for customer funds. Liquidity is equally important, as higher liquidity leads to tighter spreads and more reliable order execution. Transparent fee structures also matter, as hidden costs can quietly erode profits over time.

At Top Rated Crypto Exchanges, platforms are assessed based on professionalism, reliability, and transparency rather than marketing claims or aggressive promotions.

Why Security Should Be Your First Concern

Security is the single most important factor when choosing a crypto trading platform. In crypto, transactions cannot be reversed and there is no central authority that can recover funds if something goes wrong. That means both the platform you choose and the way you manage your account directly affect your safety. Reputable trading platforms protect users through multiple layers, such as storing most customer funds offline, enforcing two-factor authentication, monitoring unusual activity, and carrying out regular audits. These measures exist to reduce the risk of hacks, insider misuse, or operational failures.

Security is not just about technology, it is also about trust. Many experienced traders prioritise a platform’s track record and transparency over low fees or flashy features. A reliable exchange allows traders to focus on strategy rather than worrying about whether their funds are safe. On a personal level, good habits like using strong passwords, enabling security features, and separating trading funds from long-term holdings further reduce risk.

![]() Strong platforms use cold storage to protect most client funds

Strong platforms use cold storage to protect most client funds

![]() Two-factor authentication adds an extra layer of account security

Two-factor authentication adds an extra layer of account security

![]() Proof-of-reserves builds trust through transparency

Proof-of-reserves builds trust through transparency

![]() Traders often keep only active funds on exchanges

Traders often keep only active funds on exchanges

![]() Personal security habits are just as important as platform security

Personal security habits are just as important as platform security

Fees, Liquidity, and Why They Matter

Every crypto trade comes with costs, even when they are not immediately obvious. Trading platforms typically charge fees per transaction, often based on whether you add or remove liquidity. Some use tiered fee structures that reward higher trading volume, while others include costs within the price spread between buying and selling. Over time, these fees can significantly impact profitability, especially for frequent traders. Understanding how a platform charges fees helps you plan trades more accurately and avoid unpleasant surprises.

Liquidity is just as important as fees. A liquid market has enough buyers and sellers to allow trades to execute smoothly at expected prices. Low liquidity can cause slippage, where orders fill at worse prices than planned. This can be costly during volatile market conditions or when placing larger trades. Platforms with strong liquidity generally provide more stable pricing and better execution.

![]() Trading fees can vary based on volume and order type

Trading fees can vary based on volume and order type

![]() Hidden costs may exist within spreads and withdrawals

Hidden costs may exist within spreads and withdrawals

![]() High liquidity helps trades execute at expected prices

High liquidity helps trades execute at expected prices

![]() Low liquidity increases slippage risk

Low liquidity increases slippage risk

![]() Fee transparency supports better trading decisions

Fee transparency supports better trading decisions

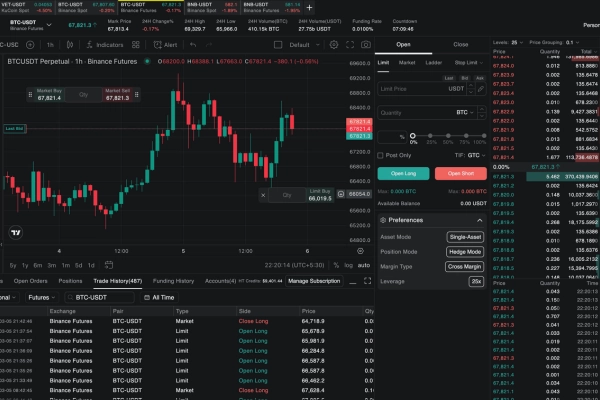

Spot Trading, Margin Trading, and Derivatives Explained Simply

Most people start crypto trading with spot markets. Spot trading means buying or selling actual cryptocurrencies and owning them directly. This approach is straightforward and easier to understand, making it suitable for beginners. You buy an asset, hold it if you choose, and sell it later based on price movement. Spot trading carries fewer risks compared to leveraged products, as you cannot lose more than your initial investment.

Margin trading and derivatives are more advanced tools. These allow traders to borrow funds or trade contracts that track price movement without owning the asset. While this can amplify gains, it also increases losses, sometimes very quickly. Without a clear understanding of leverage, margin requirements, and liquidation rules, traders can lose capital faster than expected. Beginners are generally advised to master spot trading before exploring advanced products.

![]() Spot trading involves owning the cryptocurrency directly

Spot trading involves owning the cryptocurrency directly

![]() Margin trading uses borrowed funds to increase exposure

Margin trading uses borrowed funds to increase exposure

![]() Derivatives track price without asset ownership

Derivatives track price without asset ownership

![]() Leverage increases both gains and losses

Leverage increases both gains and losses

![]() Beginners should start with spot markets first

Beginners should start with spot markets first

Risk Management: The Key to Long-Term Trading

Risk management is what keeps traders in the market over the long term. No strategy wins all the time, and losses are unavoidable. The goal is not to avoid losses entirely, but to control them so they do not outweigh gains. Basic risk management techniques include limiting how much capital is used per trade, setting stop-loss orders, and avoiding emotional decision-making during market swings.

Professional traders plan every trade before entering. They know where they will exit if the trade fails and where they will take profit if it succeeds. This structure removes guesswork and helps traders stay disciplined. In volatile crypto markets, risk management is often more important than predicting price direction.

![]() Limit the amount risked on each trade

Limit the amount risked on each trade

![]() Use stop-loss orders to control downside

Use stop-loss orders to control downside

![]() Avoid emotional trading decisions

Avoid emotional trading decisions

![]() Plan entries and exits in advance

Plan entries and exits in advance

![]() Discipline matters more than constant activity

Discipline matters more than constant activity

Learning Tools and Support for Beginners

A good crypto trading platform supports learning, not just execution. Many reputable platforms now offer demo accounts, educational articles, tutorials, and market insights designed for beginners. Demo environments allow users to practise trading without risking real money, which is especially valuable when learning how orders work and how markets react.

Education reduces mistakes and builds confidence. Beginners who take time to learn chart basics, order types, and market behaviour are better prepared for live trading. Platforms that invest in user education often attract more long-term traders, as informed users are less likely to make impulsive decisions.

![]() Demo accounts allow risk-free practice

Demo accounts allow risk-free practice

![]() Educational guides explain key trading concepts

Educational guides explain key trading concepts

![]() Tutorials help users understand platform tools

Tutorials help users understand platform tools

![]() Learning reduces beginner mistakes

Learning reduces beginner mistakes

![]() Knowledge builds long-term confidence

Knowledge builds long-term confidence

Regulation and What It Means for Traders

Regulation in crypto trading is developing across many regions. While rules differ globally, the goal is generally to protect users, improve transparency, and reduce financial crime. Regulated platforms often follow stricter standards for asset handling, disclosures, and operational security. This can provide traders with additional confidence, especially when holding funds on an exchange.

Regulation does not remove risk entirely, but it can reduce uncertainty. Traders should understand which rules apply in their region and choose platforms that operate responsibly. Compliance often affects available products, leverage limits, and onboarding requirements.

![]() Regulation aims to improve transparency and protection

Regulation aims to improve transparency and protection

![]() Rules vary depending on location

Rules vary depending on location

![]() Regulated platforms follow higher standards

Regulated platforms follow higher standards

![]() Compliance can limit risky products

Compliance can limit risky products

![]() Traders should understand local requirements

Traders should understand local requirements

Strategy, Psychology, and Staying Disciplined

Crypto markets operate continuously, which can tempt traders to overtrade or react emotionally. Sharp price movements often trigger fear or greed, leading to rushed decisions. A clear strategy helps traders stay focused and avoid chasing losses or jumping into trades without preparation.

Successful traders treat trading as a process rather than a thrill. They review performance, follow rules, and step back when emotions rise. Discipline and patience often matter more than finding the perfect trade setup.

![]() Emotional control is essential

Emotional control is essential

![]() A clear strategy reduces impulsive decisions

A clear strategy reduces impulsive decisions

![]() Overtrading increases risk

Overtrading increases risk

![]() Reviewing performance improves consistency

Reviewing performance improves consistency

![]() Patience supports better outcomes

Patience supports better outcomes

Using Crypto Promotions the Smart Way

Crypto promotions can add value, but they should never outweigh fundamentals. Fee discounts, bonuses, or rewards can reduce costs when used correctly, but they should not drive platform choice alone. Promotions often come with conditions that traders must understand fully.

Smart traders treat promotions as optional extras. They prioritise security, liquidity, and reliability first, then consider incentives as a secondary benefit. Long-term efficiency always matters more than short-term perks.

![]() Promotions can reduce trading costs

Promotions can reduce trading costs

![]() Terms and conditions always apply

Terms and conditions always apply

![]() Incentives should not override fundamentals

Incentives should not override fundamentals

![]() Security and liquidity come first

Security and liquidity come first

![]() Long-term value beats short-term rewards

Long-term value beats short-term rewards

Our Final Thoughts

Crypto trading offers global access, flexibility, and opportunity, but it also requires responsibility. The right trading platform supports security, education, risk management, and consistent execution. Building strong foundations early makes trading more sustainable and less stressful.

At Top Rated Crypto Exchanges, the focus is on helping traders compare platforms based on what truly matters. When education, discipline, and smart platform choice come together, crypto trading becomes a structured and rewarding journey rather than a gamble.

![]() Choose platforms based on trust and reliability

Choose platforms based on trust and reliability

![]() Learn before committing significant capital

Learn before committing significant capital

![]() Manage risk consistently

Manage risk consistently

![]() Use promotions wisely

Use promotions wisely

![]() Trade with long-term goals in mind

Trade with long-term goals in mind