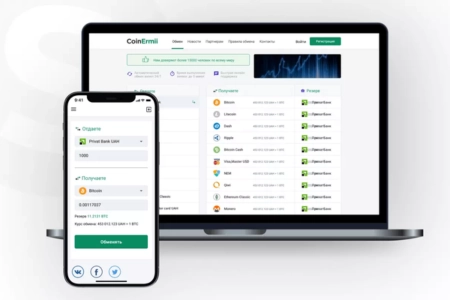

Crypto exchanges that are best for beginners focus on simplicity, clarity, and reliability. New users often want to buy cryptocurrency without dealing with complex trading tools, charts, or technical language. Beginner-friendly exchanges usually provide a streamlined interface with clear buy and sell options, making it easier to understand pricing and transactions.

Before jumping into the world of crypto exchanges, we strongly recommend taking the time to read through the

Before jumping into the world of crypto exchanges, we strongly recommend taking the time to read through the