A trustworthy crypto trading platform prioritises security, transparency, and clear communication, because in crypto, trust is not a nice-to-have, it is the foundation of every trade. Look for platforms that publish clear information about how client funds are stored, whether they use cold storage, what account protection tools are available (such as two-factor authentication), and how withdrawals are handled. You should also be able to find upfront details on fees, spreads, limits, and the platform’s approach to compliance in the regions it operates in. If a platform is vague, difficult to verify, or constantly changes terms without clarity, that is usually a red flag. At Top Rated Crypto Exchanges, our team only recommends professional, vetted crypto exchanges.

That means we focus on platforms that demonstrate consistent operational standards, publish meaningful security and risk information, and have a credible track record for user experience and reliability. No platform is risk-free, but the most trustworthy exchanges make it easier to understand what you are signing up for, how your funds are protected, and what support is available if something goes wrong. Promotions can be a bonus, but transparency and protection should always come first.

Check for clear security features, including two-factor authentication and withdrawal controls

Look for transparency on storage methods, proof of reserves, and platform policies

Look for transparency on storage methods, proof of reserves, and platform policies

Read the fee structure carefully, including spreads, maker and taker fees, and withdrawal charges

Read the fee structure carefully, including spreads, maker and taker fees, and withdrawal charges

Avoid platforms that promise guaranteed profits or pressure you with urgency tactics

Avoid platforms that promise guaranteed profits or pressure you with urgency tactics

Use exchanges with an established reputation, consistent support, and clear compliance standards

Use exchanges with an established reputation, consistent support, and clear compliance standards

Before you start crypto trading, or choose a crypto trading platform, take a moment to read our FAQs. Crypto markets run 24/7 and can move fast, so it’s easy to act on hype instead of facts. Our

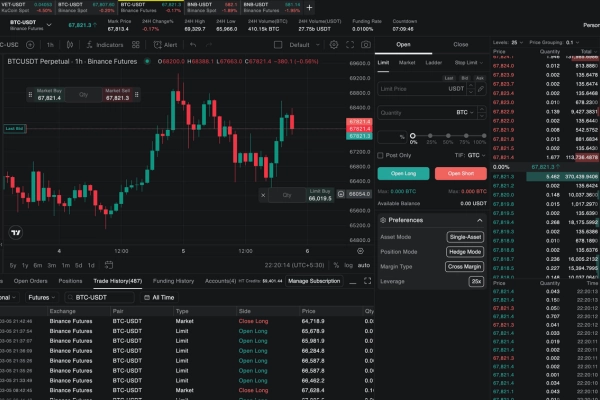

Before you start crypto trading, or choose a crypto trading platform, take a moment to read our FAQs. Crypto markets run 24/7 and can move fast, so it’s easy to act on hype instead of facts. Our  Trading cryptocurrency is basically buying and selling coins on a crypto trading platform (usually an exchange or a broker-style crypto trading app) with the aim of profiting from price moves. For crypto trading for beginners, the biggest win is keeping it simple: choose a reputable platform, secure your account, start with small amounts, and learn how orders work before you size up. The “best place to buy cryptocurrency” depends on where you live, what coins you want, fees, and how much you value features like advanced charts, staking, or instant card purchases. If you are comparing the best platform to buy cryptocurrency, focus on security controls, liquidity, and fee transparency first, then look at extras like crypto promotions.

Trading cryptocurrency is basically buying and selling coins on a crypto trading platform (usually an exchange or a broker-style crypto trading app) with the aim of profiting from price moves. For crypto trading for beginners, the biggest win is keeping it simple: choose a reputable platform, secure your account, start with small amounts, and learn how orders work before you size up. The “best place to buy cryptocurrency” depends on where you live, what coins you want, fees, and how much you value features like advanced charts, staking, or instant card purchases. If you are comparing the best platform to buy cryptocurrency, focus on security controls, liquidity, and fee transparency first, then look at extras like crypto promotions.