E-MAIL: your-email@mail.com

Ledger and Trezor are still the two biggest names in hardware wallets heading into 2026, and the “top dog” title depends on what you actually do with crypto day to

Steps, Strategies, and Safe Exit Routes Selling cryptocurrency in 2025 is no longer a niche activity reserved for early adopters and hardcore traders. It’s a normal part of modern personal

A crypto wallet is an essential tool for anyone buying, holding, or using cryptocurrency, acting as the secure bridge between you and the blockchain where your digital assets exist. Rather than storing coins themselves, crypto wallets manage the private keys that prove ownership and authorise transactions, allowing users to send, receive, and control cryptocurrencies such as Bitcoin, Ethereum, and many others with confidence. As cryptocurrencies have evolved from niche technological experiments into globally recognised financial instruments and digital stores of value, the importance of understanding how to manage and protect these assets has grown significantly.

A crypto wallet is an essential tool for anyone buying, holding, or using cryptocurrency, acting as the secure bridge between you and the blockchain where your digital assets exist. Rather than storing coins themselves, crypto wallets manage the private keys that prove ownership and authorise transactions, allowing users to send, receive, and control cryptocurrencies such as Bitcoin, Ethereum, and many others with confidence. As cryptocurrencies have evolved from niche technological experiments into globally recognised financial instruments and digital stores of value, the importance of understanding how to manage and protect these assets has grown significantly.

Choosing the right crypto wallet directly affects security, convenience, and how you interact with your funds on a day to day basis, whether that involves long term holding, regular trading, or everyday payments. Wallets generally fall into two main categories, hardware and software, and are also commonly described as hot or cold depending on whether they are connected to the internet, each offering different balances of accessibility and protection. Whether you are completely new to crypto or looking to deepen your understanding of wallet technology, gaining clarity on how wallets work, the types available, and best practices for safeguarding private keys is fundamental to using cryptocurrency safely and effectively in an increasingly digital financial landscape.

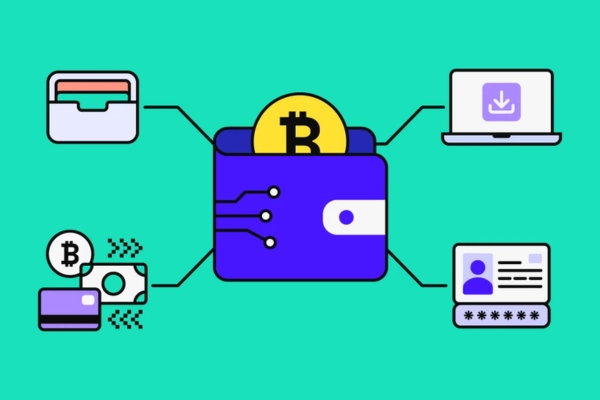

A cryptocurrency wallet is a digital tool that helps you store, manage, and use cryptocurrencies such as Bitcoin, Ethereum, and other digital assets, but it’s important to understand what it actually “stores”. Your coins remain on the blockchain, and the wallet’s real job is to protect the private keys that prove you own those assets and let you approve transactions. Think of it as your secure access pass to the blockchain rather than a container for the coins themselves.

When someone sends you crypto, the transaction is recorded on the blockchain and associated with your wallet’s public address, which you can share freely, much like sharing an email address to receive messages. To send crypto out, your wallet uses your private key to sign and authorise the transaction, confirming you’re the rightful owner without needing a bank or central authority. That freedom comes with responsibility, because if you lose your private key or recovery phrase, there’s usually no reset button and no support team that can restore access.

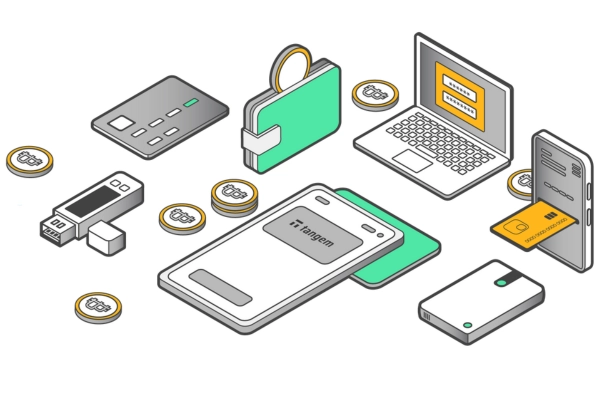

Wallets generally come in two main forms, software and hardware, and they are also commonly described as hot or cold depending on whether they are connected to the internet. Software wallets are typically hot wallets, installed on a phone or computer, or accessed via a browser, making them ideal for everyday use and quick transactions. Hardware wallets are usually cold wallets, keeping private keys offline on a physical device for stronger long term security. Many people use both, a software wallet for day to day activity and a hardware wallet for storing larger balances more safely.

![]() Stores and protects private keys and uses public addresses to receive crypto

Stores and protects private keys and uses public addresses to receive crypto

![]() Software wallets are convenient for frequent use, hardware wallets are stronger for long term storage

Software wallets are convenient for frequent use, hardware wallets are stronger for long term storage

![]() If you lose your private key or recovery phrase, you may permanently lose access to your funds

If you lose your private key or recovery phrase, you may permanently lose access to your funds

![]() A balanced setup often uses a hot wallet for spending and a cold wallet for savings or holdings

A balanced setup often uses a hot wallet for spending and a cold wallet for savings or holdings

![]() Treat your recovery phrase like the keys to a safe, offline storage and never share it

Treat your recovery phrase like the keys to a safe, offline storage and never share it

When you “own” cryptocurrency, you are really controlling cryptographic keys, not physical coins or even digital coins stored inside an app. Your crypto remains recorded on the blockchain, which is a distributed ledger that tracks balances and transactions across a network of computers. A crypto wallet works as the secure interface between you and that blockchain, allowing you to view your balances, generate receiving addresses, and authorise transfers. The most important point is this: your wallet does not move coins around like a bank transfer, it creates and signs instructions that the blockchain network can verify. Once verified, the transaction is added to the blockchain and your balance updates accordingly. This is why protecting your private key, or your recovery phrase, is so critical, because it is the proof that you have the right to spend the funds linked to your address.

Here is a simplified breakdown of the process

![]() Key generation: Your wallet generates a unique pair of cryptographic keys, a public key and a private key.

Key generation: Your wallet generates a unique pair of cryptographic keys, a public key and a private key.

![]() Receiving funds: Your public key is used to create a wallet address that you can share to receive cryptocurrency.

Receiving funds: Your public key is used to create a wallet address that you can share to receive cryptocurrency.

![]() Sending funds: Your private key signs transactions, proving you own the assets and authorising the transfer.

Sending funds: Your private key signs transactions, proving you own the assets and authorising the transfer.

![]() Network verification: The blockchain network checks the signature, confirms it is valid, and then records the transaction on the blockchain.

Network verification: The blockchain network checks the signature, confirms it is valid, and then records the transaction on the blockchain.

![]() Balance update: Once confirmed, your wallet shows the updated balance based on what the blockchain records.

Balance update: Once confirmed, your wallet shows the updated balance based on what the blockchain records.

Because wallets are built to interact with blockchains, many of them support multiple networks and assets. That can include cryptocurrencies, stablecoins, and tokenised assets such as NFTs, giving you one central place to manage a wide range of digital holdings.

A private key is a secret piece of cryptographic data that proves your ownership of cryptocurrency and gives you full control over the funds in a crypto wallet. It functions like a digital signature or master password, allowing you to authorise transactions on the blockchain. When you send cryptocurrency, your wallet uses the private key to sign the transaction, confirming to the network that you are the legitimate owner of the assets being moved. Without the private key, you cannot access or spend your cryptocurrency, even though it still exists on the blockchain.

Every crypto wallet generates a matching pair of keys: a public key, which is used to create your wallet address and can be shared safely, and a private key, which must remain completely confidential. While the public key allows others to send cryptocurrency to your wallet, the private key is what unlocks the ability to move those funds. Because blockchains are decentralised, there is no central authority that can reset or recover a private key if it is lost or stolen, which is why protecting it is one of the most important aspects of crypto security.

![]() Acts as proof of ownership and authorises transactions

Acts as proof of ownership and authorises transactions

![]() Must never be shared with anyone

Must never be shared with anyone

![]() Losing it usually means permanent loss of access to funds

Losing it usually means permanent loss of access to funds

There are several types of cryptocurrency wallets, each designed to suit different levels of experience, security needs, and how often you plan to use your crypto. While all wallets serve the same core purpose, storing and protecting private keys, they differ in how those keys are stored and accessed. Crypto wallets are most commonly categorised by hardware vs software, hot vs cold, and custodial vs non-custodial. Understanding these types helps you choose the right wallet for your goals, whether that is long term investing, active trading, or everyday use.

Hardware wallets are physical devices that store private keys offline. Because they are not connected to the internet, they are considered one of the most secure ways to store cryptocurrency. Transactions must be approved directly on the device, adding an extra layer of protection.

![]() Private keys remain offline at all times

Private keys remain offline at all times

![]() Ideal for long term storage and larger balances

Ideal for long term storage and larger balances

![]() Less convenient for frequent transactions

Less convenient for frequent transactions

Software wallets are applications installed on a mobile phone, desktop computer, or accessed through a web browser. They are easy to use and quick to set up, making them popular with beginners and active users. These wallets are usually connected to the internet.

![]() Convenient and user friendly

Convenient and user friendly

![]() Suitable for regular sending and receiving

Suitable for regular sending and receiving

![]() Security depends on the device and user habits

Security depends on the device and user habits

Hot wallets are wallets that are connected to the internet. Most software wallets fall into this category. They allow fast access to funds and are commonly used for trading, spending, and interacting with decentralised cryptocurrency apps.

![]() Always online for quick access

Always online for quick access

![]() Best for small balances and frequent use

Best for small balances and frequent use

![]() Higher exposure to online security risks

Higher exposure to online security risks

Cold wallets store private keys offline. Hardware wallets are the most common type, but paper wallets also fall into this category. Cold wallets are preferred for secure, long term storage.

![]() Offline storage reduces hacking risk

Offline storage reduces hacking risk

![]() Strong choice for holding crypto long term

Strong choice for holding crypto long term

![]() Not designed for everyday transactions

Not designed for everyday transactions

Custodial wallets are managed by third parties, such as crypto exchanges. The provider holds the private keys on your behalf, which can make things easier for beginners but reduces personal control.

![]() Simple setup and recovery options

Simple setup and recovery options

![]() Provider controls the private keys

Provider controls the private keys

![]() Less control over your funds

Less control over your funds

Non-custodial wallets give you full ownership of your private keys. You are fully responsible for security and backups, but you also have complete control over your crypto.

![]() Full ownership and control

Full ownership and control

![]() No reliance on third parties

No reliance on third parties

![]() Requires careful key management

Requires careful key management

Choosing between a hardware wallet and a software wallet comes down to how you balance security, convenience, and how you use your cryptocurrency. Both types of wallets store and manage private keys, but they do so in very different ways, which directly impacts their strengths. Hardware wallets are physical devices designed to keep private keys offline, while software wallets are apps or programmes that run on phones, computers, or browsers and are usually connected to the internet. Understanding the benefits of each helps you decide which option suits your needs, or whether a combination of both is the most practical approach.

Hardware wallets are widely regarded as the most secure way to store cryptocurrency. Because private keys are kept offline, they are protected from online threats such as hacking, malware, and phishing attacks. Even when a hardware wallet is connected to a computer or mobile device to approve a transaction, the private key never leaves the device. This makes hardware wallets particularly attractive for long term holders and anyone storing larger amounts of crypto who wants maximum protection.

![]() Private keys remain offline at all times

Private keys remain offline at all times

![]() Strong protection against online attacks

Strong protection against online attacks

![]() Ideal for long term storage and large balances

Ideal for long term storage and large balances

![]() Transactions require physical confirmation on the device

Transactions require physical confirmation on the device

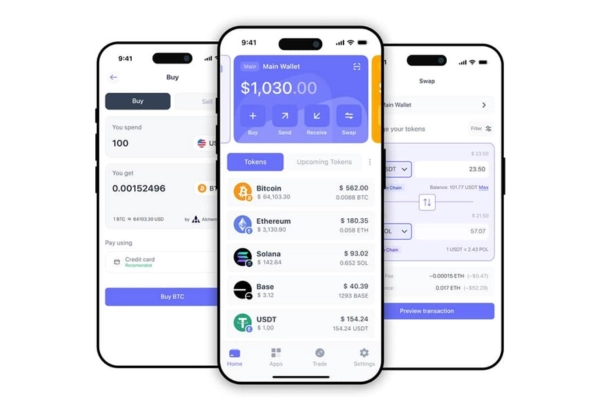

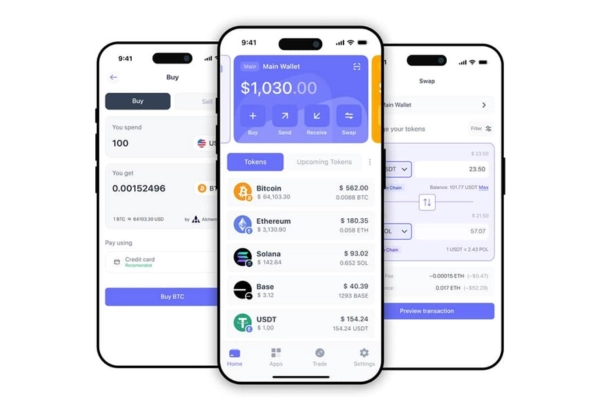

Software wallets focus on accessibility and ease of use. They are quick to set up, often free, and allow instant access to funds, making them ideal for regular transactions and everyday use. They are commonly used for trading, payments, and interacting with decentralised applications, as they integrate easily with exchanges and blockchain services. While they rely more heavily on device security, good practices such as strong passwords and backups can still make them a reliable option for smaller balances.

![]() Easy to install and user friendly

Easy to install and user friendly

![]() Quick access for sending and receiving crypto

Quick access for sending and receiving crypto

![]() Suitable for trading and frequent transactions

Suitable for trading and frequent transactions

![]() Often support multiple assets and networks

Often support multiple assets and networks

The difference between custodial and non-custodial wallets is one of the most important concepts to understand when using cryptocurrency. At its core, this distinction comes down to who controls the private keys. Custodial wallets are managed by a third party, usually a crypto exchange or financial platform, while non-custodial wallets give you full ownership and control of your keys and funds. Each option offers clear benefits depending on your experience level, risk tolerance, and how you plan to use your crypto.

Custodial wallets are wallets where a third party holds and manages the private keys on your behalf. This setup is common on crypto exchanges and investment platforms, where users log in with a username and password rather than managing keys directly. The biggest benefit of custodial wallets is simplicity. They remove much of the technical responsibility from the user, making them ideal for beginners or anyone who prefers a more familiar, bank-like experience. Account recovery is usually possible if you forget your password, and customer support is often available to help resolve issues.

![]() Easy to use with minimal technical knowledge

Easy to use with minimal technical knowledge

![]() Password recovery and account support are usually available

Password recovery and account support are usually available

![]() Suitable for beginners and frequent traders

Suitable for beginners and frequent traders

![]() Often integrated directly with exchanges and trading tools

Often integrated directly with exchanges and trading tools

Non-custodial wallets, by contrast, put you fully in control. In this setup, only you hold the private keys or recovery phrase, meaning no third party can access or move your funds without your permission. This aligns closely with the original principles of cryptocurrency, decentralisation, self-sovereignty, and financial independence. Non-custodial wallets can be software wallets or hardware wallets, and they allow you to interact directly with blockchains, decentralised applications, and peer-to-peer transfers without intermediaries.

![]() Full ownership and control of private keys

Full ownership and control of private keys

![]() No reliance on third parties to access funds

No reliance on third parties to access funds

![]() Greater privacy and resistance to platform restrictions

Greater privacy and resistance to platform restrictions

![]() Direct access to decentralised services and applications

Direct access to decentralised services and applications

Securing your crypto wallet matters because control of the private key, or the recovery phrase that represents it, equals control of the funds. If an attacker gets hold of that information, they do not need permission from a bank or platform to move your crypto, they can simply sign transactions and transfer assets out. That is why good wallet security is less about “one perfect setting” and more about layering protections: safe storage of your recovery phrase, strong device hygiene, careful verification of apps and websites, and sensible habits around how much you keep in hot wallets versus cold storage. For most people, the biggest real-world risks are not complex hacks, they are phishing links, fake wallet apps, malicious browser extensions, SIM swap scams, and accidental exposure of seed phrases through screenshots, cloud backups, or messages. The goal is to reduce your exposure, limit the damage if one layer fails, and make recovery possible if you lose a device while ensuring attackers still cannot access your funds.

![]() Treat your recovery phrase like a master key, keep it offline, private, and protected from damage

Treat your recovery phrase like a master key, keep it offline, private, and protected from damage

![]() Use layered security, including strong passwords, device locks, and 2FA where available

Use layered security, including strong passwords, device locks, and 2FA where available

![]() Download wallets only from official sources and verify domains carefully before connecting a wallet

Download wallets only from official sources and verify domains carefully before connecting a wallet

![]() Keep smaller “spending” balances in hot wallets, store larger holdings in cold storage

Keep smaller “spending” balances in hot wallets, store larger holdings in cold storage

![]() Watch for common traps like fake support messages, urgent popups, and lookalike websites

Watch for common traps like fake support messages, urgent popups, and lookalike websites

A recovery phrase, also known as a seed phrase, is a series of words generated by a crypto wallet that acts as a human readable backup of your private keys. It is typically made up of 12 or 24 random words and gives complete access to the cryptocurrency stored in that wallet. If your phone, computer, or hardware wallet is lost, damaged, or replaced, the recovery phrase allows you to restore your wallet and regain access to your funds on a new device. In practical terms, the recovery phrase is more important than the wallet app or device itself, because anyone who has this phrase can recreate the wallet and control the assets associated with it. For this reason, it must be treated as highly sensitive information and protected with extreme care.

When you first set up a non-custodial wallet, you are usually shown the recovery phrase once and asked to confirm it. This process exists to ensure you have recorded it correctly, because there is no central authority that can help you recover it later. If the recovery phrase is lost, access to the wallet and its funds is usually lost permanently. If it is exposed, stolen, or photographed, an attacker can restore the wallet elsewhere without your knowledge and move the funds. This makes safe storage and careful handling of the recovery phrase one of the most critical responsibilities in crypto ownership.

![]() A recovery phrase is a backup that can fully restore a crypto wallet

A recovery phrase is a backup that can fully restore a crypto wallet

![]() It usually consists of 12 or 24 random words generated by the wallet

It usually consists of 12 or 24 random words generated by the wallet

![]() Anyone with the phrase can access and control the wallet’s funds

Anyone with the phrase can access and control the wallet’s funds

![]() Losing it often means permanent loss of access to your crypto

Losing it often means permanent loss of access to your crypto

![]() It should never be shared, uploaded, or stored digitally

It should never be shared, uploaded, or stored digitally

Choosing the right wallet is really about matching your storage setup to how you use crypto, how much you hold, and how comfortable you are with personal responsibility. If you trade often, move funds regularly, or use decentralised apps, a hot software wallet can be the most practical option because it is quick, accessible, and built for frequent transactions. If you are holding crypto as a long-term investment, or storing a larger balance you would not want to risk losing, cold storage becomes far more appealing because it reduces exposure to online threats. Custodial versus non-custodial is another key decision. Custodial wallets can feel simpler and more familiar, with logins, password resets, and customer support, but you are trusting a third party to safeguard access. Non-custodial wallets give you full control, but you are responsible for protecting your recovery phrase and cannot rely on account recovery if you lose it. In practice, many people end up with a “two wallet” system because it reflects real behaviour: a secure long-term wallet for holdings, plus a convenient everyday wallet for spending, swapping, or interacting with apps.

![]() If you transact frequently, prioritise speed and usability, but keep balances modest

If you transact frequently, prioritise speed and usability, but keep balances modest

![]() If you hold long term, prioritise offline storage and strong backups

If you hold long term, prioritise offline storage and strong backups

![]() If you want simplicity, custodial may suit you, if you want control, go non-custodial

If you want simplicity, custodial may suit you, if you want control, go non-custodial

![]() Choose wallets that support the blockchains and tokens you actually use

Choose wallets that support the blockchains and tokens you actually use

![]() Plan a setup that still works if you lose a phone, change devices, or travel

Plan a setup that still works if you lose a phone, change devices, or travel

Different crypto users have very different needs, so the “best” wallet is rarely one-size-fits-all. The right choice depends on how confident you feel managing security, how often you plan to transact, and whether you mainly hold assets long term or regularly interact with decentralised apps. A good rule is to match convenience to risk: the more frequently you use crypto, the more you’ll value fast access, and the more value you hold, the more you should prioritise offline protection and careful backup habits. It’s also worth remembering that wallets fall into two practical worlds, custodial (a provider holds the keys) and non-custodial (you hold the keys). For many users, a blended setup makes the most sense, using a convenient wallet for everyday activity and a higher-security option for savings-style storage.

If you’re new to cryptocurrency, choose a wallet that’s simple to navigate and reduces the chance of costly mistakes. Coinbase Wallet is often recommended because it’s easy to use, supports multiple assets, and can link with a Coinbase account for smoother transfers between your exchange balance and your wallet. Focus on strong habits early, back up your recovery phrase correctly, secure your device, and practise with small test transactions before moving larger amounts.

![]() Choose a clean interface with simple send and receive flows

Choose a clean interface with simple send and receive flows

![]() Pick a wallet that makes exchange transfers easy

Pick a wallet that makes exchange transfers easy

![]() Start small, do a test transfer first

Start small, do a test transfer first

![]() Store your recovery phrase offline, never in screenshots or cloud notes

Store your recovery phrase offline, never in screenshots or cloud notes

![]() Ignore urgent “support” messages, scams often target beginners

Ignore urgent “support” messages, scams often target beginners

More experienced users usually want greater control, customisation, and smooth access to Web3 tools. MetaMask is widely used for connecting to decentralised apps, DeFi platforms, token swaps, and NFTs, largely because it’s non-custodial and designed for dApp connectivity. For Bitcoin users, Electrum is a popular lightweight choice with advanced features such as multi-signature support. Advanced users often segment wallets by purpose and keep a close eye on smart contract approvals and connected sites

![]() MetaMask is popular for DeFi, dApps, and NFTs

MetaMask is popular for DeFi, dApps, and NFTs

![]() Electrum supports advanced Bitcoin features, including multisig

Electrum supports advanced Bitcoin features, including multisig

![]() Separate wallets for trading, long-term holds, and testing

Separate wallets for trading, long-term holds, and testing

![]() Review token approvals and revoke access you no longer need

Review token approvals and revoke access you no longer need

![]() Add a hardware wallet for stronger signing security

Add a hardware wallet for stronger signing security

If you’re holding crypto for months or years, especially larger amounts, a hardware wallet is typically the safest option because it keeps private keys offline and reduces exposure to online threats. Ledger and Trezor are well-known examples, and they protect you by signing transactions on the device so your private keys aren’t exposed on an internet-connected phone or computer. Long-term security also depends heavily on your recovery phrase storage, so use durable, offline backups and have a clear plan if the device is lost or damaged

![]() Hardware wallets store private keys offline and sign securely

Hardware wallets store private keys offline and sign securely

![]() Best for long-term holding and larger balances

Best for long-term holding and larger balances

![]() Keep recovery phrases offline, consider a durable backup

Keep recovery phrases offline, consider a durable backup

![]() Use a hot wallet only for spending, keep the rest in cold storage

Use a hot wallet only for spending, keep the rest in cold storage

![]() Test recovery steps safely so you know you can restore access

Test recovery steps safely so you know you can restore access

Before you start buying, storing, or using cryptocurrency, we strongly recommend taking a few moments to read through our Crypto Wallet FAQs. Wallets are the foundation of crypto ownership, because they control how you access your funds and how securely your private keys are protected. Without a clear understanding of how wallets work, it is easy to make mistakes that are difficult, and sometimes impossible, to reverse, such as sending funds to the wrong address, falling for phishing scams, or losing access by misplacing a recovery phrase. If you have any further questions, please feel free to contact the team at Top Rated Crypto Exchanges.

Before you start buying, storing, or using cryptocurrency, we strongly recommend taking a few moments to read through our Crypto Wallet FAQs. Wallets are the foundation of crypto ownership, because they control how you access your funds and how securely your private keys are protected. Without a clear understanding of how wallets work, it is easy to make mistakes that are difficult, and sometimes impossible, to reverse, such as sending funds to the wrong address, falling for phishing scams, or losing access by misplacing a recovery phrase. If you have any further questions, please feel free to contact the team at Top Rated Crypto Exchanges.

There isn’t one single “best” crypto wallet for everyone, because the right choice depends on how you use crypto, how much you plan to store, and how comfortable you are taking responsibility for security. At a practical level, a wallet is a tool for managing the keys that control your assets on the blockchain, so the “best” wallet is the one that fits your habits and reduces your risks. If you want maximum control, a non-custodial wallet means you hold your own access keys, but you must protect your recovery phrase properly. If you want long-term security for larger holdings, many users prefer a hardware wallet because it keeps private keys offline and signs transactions securely without exposing the keys to an internet-connected device. If you are active in DeFi or NFTs, you may prioritise dApp connectivity and network support. A sensible approach for many people is a two-wallet setup: a cold wallet for “savings” and a hot wallet for day-to-day transactions, with only small amounts kept online.

There isn’t one single “best” crypto wallet for everyone, because the right choice depends on how you use crypto, how much you plan to store, and how comfortable you are taking responsibility for security. At a practical level, a wallet is a tool for managing the keys that control your assets on the blockchain, so the “best” wallet is the one that fits your habits and reduces your risks. If you want maximum control, a non-custodial wallet means you hold your own access keys, but you must protect your recovery phrase properly. If you want long-term security for larger holdings, many users prefer a hardware wallet because it keeps private keys offline and signs transactions securely without exposing the keys to an internet-connected device. If you are active in DeFi or NFTs, you may prioritise dApp connectivity and network support. A sensible approach for many people is a two-wallet setup: a cold wallet for “savings” and a hot wallet for day-to-day transactions, with only small amounts kept online.

![]() Pick based on your use case, trading, holding, DeFi, or payments

Pick based on your use case, trading, holding, DeFi, or payments

![]() Prefer cold storage for larger, long-term holdings

Prefer cold storage for larger, long-term holdings

![]() Use hot wallets for smaller, everyday balances

Use hot wallets for smaller, everyday balances

![]() Choose reputable providers and official download sources

Choose reputable providers and official download sources

![]() Prioritise recovery phrase security before moving significant funds

Prioritise recovery phrase security before moving significant funds

The best Bitcoin wallet depends on whether you want simplicity, advanced control, or maximum long-term security. Bitcoin wallets create addresses to receive funds and use private keys to authorise spending, so your choice should focus on how safely you can manage those keys. If you are holding Bitcoin for the long term, a hardware wallet is commonly recommended because it keeps private keys offline, reducing exposure to malware and phishing on everyday devices. If you are a more advanced user, you might prefer a wallet that supports features such as multi-signature, which can reduce single-point-of-failure risk by requiring more than one approval method to move funds. If you want something user-friendly, you may prefer a mainstream wallet with a clear interface and strong guidance around backups. Whatever you choose, remember that Bitcoin transactions are generally irreversible, so address checks and careful verification matter.

![]() Long-term holding usually suits hardware wallets

Long-term holding usually suits hardware wallets

![]() Advanced users may want multisig support

Advanced users may want multisig support

![]() Beginners should prioritise simple UX and safe backup flows

Beginners should prioritise simple UX and safe backup flows

![]() Always verify addresses carefully, transactions are typically irreversible

Always verify addresses carefully, transactions are typically irreversible

![]() Choose a wallet that fits how often you move Bitcoin

Choose a wallet that fits how often you move Bitcoin

If you’re new to crypto, the best wallet is usually one that is easy to navigate, makes sending and receiving feel clear, and reduces the chance of mistakes. Beginner-friendly wallets typically guide you through setup, highlight the importance of the recovery phrase, and make it easy to copy and share your receiving address without confusion. A common beginner path is to start with a reputable software wallet for small amounts, then move to a hardware wallet once you’re holding more value or want stronger long-term security. The key is not chasing features, it’s building safe habits. That means writing down your recovery phrase correctly and storing it offline, keeping your phone or computer protected with a strong passcode, and doing a small test transaction before moving larger funds. Recovery phrases are effectively the master backup for many wallets, so protecting them is the single most important beginner skill.

![]() Start with a reputable, beginner-friendly software wallet

Start with a reputable, beginner-friendly software wallet

![]() Keep balances small while you learn

Keep balances small while you learn

![]() Do a test transfer before moving larger amounts

Do a test transfer before moving larger amounts

![]() Store your recovery phrase offline, never in screenshots or cloud notes

Store your recovery phrase offline, never in screenshots or cloud notes

![]() Upgrade to a hardware wallet as your holdings grow

Upgrade to a hardware wallet as your holdings grow

“Safest” usually means the wallet setup that most reduces your exposure to online threats while still being realistic for you to use consistently. For many people, a hardware wallet is considered one of the safest options because it stores private keys offline and signs transactions without exposing the keys to an internet-connected device. That said, no wallet is “safe” if the recovery phrase is mishandled. A recovery phrase can restore the entire wallet, so anyone who gets it can take the funds, even if you’re using a hardware wallet. The safest approach is usually a combination: cold storage for long-term holdings, careful offline backups of the recovery phrase, and a small hot wallet balance for day-to-day use. If you hold assets on an exchange, your security also depends on the platform, so you’re trading simplicity for reliance on a third party.

![]() Hardware wallets generally reduce online attack risk

Hardware wallets generally reduce online attack risk

![]() Your recovery phrase security is as important as the wallet itself

Your recovery phrase security is as important as the wallet itself

![]() Use cold storage for long-term holdings

Use cold storage for long-term holdings

![]() Keep only small amounts in hot wallets

Keep only small amounts in hot wallets

![]() Avoid storing recovery phrases digitally or sharing them with anyone

Avoid storing recovery phrases digitally or sharing them with anyone

Crypto wallets can be safe to use, but safety depends heavily on the type of wallet and your security habits. With non-custodial wallets, you control the access keys, which is empowering, but it also means you’re responsible for protecting the recovery phrase and avoiding scams. Many real-world losses happen through phishing, fake “support” messages, or counterfeit wallet apps that trick users into handing over recovery phrases. On the other hand, custodial wallets can feel simpler because there may be login recovery, but you rely on the provider’s security and policies. The safest way to use wallets is to keep your recovery phrase offline, verify websites and apps carefully, use strong device security, and keep larger holdings in cold storage.

![]() Wallet safety is real, but user behaviour is a major factor

Wallet safety is real, but user behaviour is a major factor

![]() Never share your recovery phrase, legitimate services won’t ask for it

Never share your recovery phrase, legitimate services won’t ask for it

![]() Use official apps and verify domains carefully

Use official apps and verify domains carefully

![]() Keep larger balances in cold storage

Keep larger balances in cold storage

![]() Treat exchange custody as third-party risk

Treat exchange custody as third-party risk

In most cases, hardware wallets are more secure than software wallets for long-term storage, because hardware wallets keep private keys offline and reduce exposure to malware and phishing on everyday internet-connected devices. Software wallets are hot by design, they live on phones, desktops, or browsers, and they are convenient for frequent transactions, but they are more exposed to threats like malicious extensions, compromised devices, and fake apps. However, “more secure” does not mean “invulnerable”. If someone obtains your recovery phrase, they can restore your wallet elsewhere and take the funds regardless of whether you used hardware or software. Hardware wallets also require safe physical storage and careful setup. The best practice many users adopt is to keep most holdings on a hardware wallet and only keep spending money in a software wallet, reducing potential damage if a phone or computer is compromised.

![]() Hardware wallets typically reduce online attack exposure

Hardware wallets typically reduce online attack exposure

![]() Software wallets are more convenient for frequent use

Software wallets are more convenient for frequent use

![]() Recovery phrase security is critical for both types

Recovery phrase security is critical for both types

![]() Use a two-wallet approach for balance and risk management

Use a two-wallet approach for balance and risk management

![]() Always verify transaction details before signing

Always verify transaction details before signing

A hardware wallet is a physical device designed to store private keys offline and sign transactions securely, while a software wallet is an app or programme that stores keys on an internet-connected device such as a phone, computer, or browser extension. The key difference is exposure. Software wallets are fast and convenient, but their security depends on the device they run on, meaning malware, phishing, and fake apps can be a bigger risk. Hardware wallets keep keys isolated, so even if your computer is compromised, the private keys should not be exposed, and you typically must physically confirm transactions on the device. Recovery phrases apply to both. A recovery phrase is the backup that can restore your wallet, so whoever has it can access the funds, which is why it must be stored offline and never shared.

![]() Hardware wallet: offline key storage and secure signing

Hardware wallet: offline key storage and secure signing

![]() Software wallet: convenient app-based access on connected devices

Software wallet: convenient app-based access on connected devices

![]() Software wallets suit small balances and frequent transactions

Software wallets suit small balances and frequent transactions

![]() Hardware wallets suit larger balances and long-term storage

Hardware wallets suit larger balances and long-term storage

![]() Recovery phrase protection matters for both types

Recovery phrase protection matters for both types

Hot wallets are connected to the internet and are designed for convenience, speed, and frequent transactions. Cold wallets keep keys offline, reducing exposure to online threats, and are typically used for long-term storage. Most software wallets are hot wallets, while hardware wallets are commonly used as cold wallets because they store private keys offline and only connect briefly to sign transactions. A key point is that “hot vs cold” is really about the attack surface. Hot wallets are more exposed to phishing, malware, and counterfeit apps, so they are best for smaller balances. Cold wallets reduce those risks, but you must store the recovery phrase safely because it can restore the wallet.

![]() Hot wallets: online, convenient, higher exposure to online threats

Hot wallets: online, convenient, higher exposure to online threats

![]() Cold wallets: offline, stronger for long-term storage

Cold wallets: offline, stronger for long-term storage

![]() Hot wallets suit spending and active use

Hot wallets suit spending and active use

![]() Cold wallets suit saving and holding larger amounts

Cold wallets suit saving and holding larger amounts

![]() Recovery phrase security remains essential either way

Recovery phrase security remains essential either way

An exchange wallet can be enough for some users, especially beginners who are making small purchases and want a straightforward experience. However, it’s important to understand what you trade for convenience: in a custodial setup, the platform controls the private keys, so your access depends on that provider’s security and operational reliability. The reason many people adopt non-custodial wallets is to hold their own keys and reduce reliance on third parties, especially for long-term holdings. A practical middle ground is to keep trading balances on an exchange for liquidity and keep long-term holdings in self-custody, often using cold storage. If you choose self-custody, you must protect your recovery phrase because it restores access to the wallet and funds.

![]() Exchange wallets are convenient, but introduce third-party risk

Exchange wallets are convenient, but introduce third-party risk

![]() Non-custodial wallets give you direct control of keys

Non-custodial wallets give you direct control of keys

![]() Consider exchange for trading, self-custody for long-term holding

Consider exchange for trading, self-custody for long-term holding

![]() Always protect your recovery phrase in self-custody setups

Always protect your recovery phrase in self-custody setups

![]() Start simple, then upgrade security as holdings grow

Start simple, then upgrade security as holdings grow

You can get a crypto wallet in two main ways: install a reputable software wallet on your phone or computer, or buy a hardware wallet from an official manufacturer. During setup, most non-custodial wallets generate a recovery phrase which can restore your wallet if you lose the device. You should write that phrase down and store it offline, because anyone who gets it can access your funds. Once your wallet is set up, you can receive crypto by sharing your wallet address. Before transferring large amounts, it’s wise to do a small test transfer to confirm you copied the correct address and selected the correct network. Also remember that many crypto transactions are irreversible, so careful checking matters.

![]() Choose software wallet (convenience) or hardware wallet (security)

Choose software wallet (convenience) or hardware wallet (security)

![]() Set up the wallet and record the recovery phrase offline

Set up the wallet and record the recovery phrase offline

![]() Secure your device with a strong passcode and updates

Secure your device with a strong passcode and updates

![]() Do a small test transfer before moving larger funds

Do a small test transfer before moving larger funds

![]() Double-check network and address each time

Double-check network and address each time

Yes, many wallets support multiple cryptocurrencies, but it depends on which blockchains the wallet supports. A wallet may support several assets on the same network, while another wallet might support multiple networks. The important detail is that “support” is not just about the coin name, it’s about the network and token standard. You must ensure you are using the correct network when receiving or sending funds, because sending a token to the wrong network address can lead to loss or complicated recovery attempts. Wallets are managing keys and addresses, and your balance is reflected on the blockchain. If you hold a diverse portfolio, a multi-chain wallet can simplify management, but it can also increase complexity, so it helps to keep records of what you hold and where.

Yes, many wallets support multiple cryptocurrencies, but it depends on which blockchains the wallet supports. A wallet may support several assets on the same network, while another wallet might support multiple networks. The important detail is that “support” is not just about the coin name, it’s about the network and token standard. You must ensure you are using the correct network when receiving or sending funds, because sending a token to the wrong network address can lead to loss or complicated recovery attempts. Wallets are managing keys and addresses, and your balance is reflected on the blockchain. If you hold a diverse portfolio, a multi-chain wallet can simplify management, but it can also increase complexity, so it helps to keep records of what you hold and where.

![]() Many wallets support multiple assets, but check network support

Many wallets support multiple assets, but check network support

![]() Always use the correct blockchain network for deposits and withdrawals

Always use the correct blockchain network for deposits and withdrawals

![]() Multi-chain wallets can simplify portfolios but add complexity

Multi-chain wallets can simplify portfolios but add complexity

![]() Consider separate wallets if you want clearer separation of risk

Consider separate wallets if you want clearer separation of risk

![]() Do a test transfer when using a new asset or network

Do a test transfer when using a new asset or network

Often yes, but only if the wallet supports the relevant blockchains and token standards. Bitcoin is its own network, Ethereum and many NFTs use smart contract standards, and stablecoins can exist on multiple networks. Many modern wallets can manage several networks from one interface, but the technical reality is still network-specific. Your wallet manages keys and addresses, while assets remain recorded on each blockchain. NFTs typically live on chains that support smart contracts, so a wallet may support Bitcoin but not NFTs, or it may support NFTs on one chain but not another. The safest approach is to confirm network support before you send anything, and to keep your wallet software updated. If you regularly use NFTs and DeFi, you also need to manage smart contract permissions carefully, because approvals can create risks even if your private keys are not stolen.

![]() Many wallets can support multiple asset types, but check chain support

Many wallets can support multiple asset types, but check chain support

![]() NFTs require compatible smart contract networks

NFTs require compatible smart contract networks

![]() Stablecoins exist on multiple chains, verify the network each time

Stablecoins exist on multiple chains, verify the network each time

![]() Keep track of which assets are on which networks

Keep track of which assets are on which networks

![]() Review token approvals if you use DeFi or NFT marketplaces

Review token approvals if you use DeFi or NFT marketplaces

A fiat wallet is a balance or account that holds traditional currency such as GBP, EUR, or USD within a financial app, exchange, or payment platform. It is not a blockchain wallet in the same sense as a crypto wallet, because it does not use private keys to control on-chain assets. Instead, it’s typically an internal account balance managed by a provider, similar to how an online bank account shows your funds. On many crypto exchanges, fiat wallets are used for depositing money from a bank account, holding cash between trades, and buying crypto. The key benefit is simplicity and stability, since fiat does not fluctuate like crypto. The main consideration is that the provider controls the account, so access depends on the platform’s policies and security.

Holds traditional currency rather than crypto assets

![]() Usually managed by an exchange or platform, not self-custodied

Usually managed by an exchange or platform, not self-custodied

![]() Useful for deposits, withdrawals, and trading in and out of crypto

Useful for deposits, withdrawals, and trading in and out of crypto

![]() Helps reduce volatility exposure when you want to stay in cash

Helps reduce volatility exposure when you want to stay in cash

![]() Access depends on the provider’s security and policies

Access depends on the provider’s security and policies

A private key is the secret credential that allows you to authorise transactions and control cryptocurrency linked to your wallet addresses. It’s often compared to a password, but it is more powerful than a typical login because it provides cryptographic proof that you are allowed to spend the funds. When you send crypto, your wallet uses the private key to sign the transaction, and the network verifies that signature before recording it on the blockchain. In many modern wallets, you are not shown each private key directly. Instead, you are given a recovery phrase which can regenerate the wallet’s keys and restore access if your device is lost. This is why private key security is so critical. If someone obtains your private key or recovery phrase, they can take your funds. If you lose them, you may permanently lose access, because there is no central authority to reset them.

![]() Private keys authorise transactions and prove ownership

Private keys authorise transactions and prove ownership

![]() Anyone with the private key can control the funds

Anyone with the private key can control the funds

![]() Losing the key can mean losing access permanently

Losing the key can mean losing access permanently

![]() Recovery phrases can regenerate private keys

Recovery phrases can regenerate private keys

![]() Store recovery information offline and never share it

Store recovery information offline and never share it

A recovery phrase is a list of words, commonly 12 or 24, that can restore your wallet and regenerate the keys used to access your funds. You need it because wallets can be lost, phones can break, laptops can be replaced, and hardware devices can be damaged. The recovery phrase is the backup that lets you restore access on a new device. The same feature that makes it useful also makes it sensitive: anyone who has your recovery phrase can restore the wallet and move the funds. That is why reputable providers warn users to write it down and store it offline, and why legitimate support teams will never ask for it. A strong recovery phrase process is fundamental to safe self-custody, because it is the ultimate key to your assets.

![]() A recovery phrase restores your wallet and funds

A recovery phrase restores your wallet and funds

![]() It is typically 12 or 24 words, generated during setup

It is typically 12 or 24 words, generated during setup

![]() Anyone with it can access your wallet, treat it like a master key

Anyone with it can access your wallet, treat it like a master key

![]() Store it offline, securely, and never share it

Store it offline, securely, and never share it

![]() Legitimate providers will not request it, scammers often do

Legitimate providers will not request it, scammers often do

If you lose a private key or recovery phrase for a non-custodial wallet, recovery may not be possible, which is one of the main responsibilities of self-custody. Your first step is to check whether you still have access on any device where the wallet is currently logged in. If you do, you may be able to create a new wallet, secure the new recovery phrase properly, and transfer funds across. If you no longer have access anywhere and the recovery phrase is gone, you may be permanently locked out, because blockchains do not have a central recovery mechanism. If your wallet is custodial, the situation is different, you may be able to recover access through the provider’s account recovery, although that depends on their policies.

![]() Check if you’re still logged in on any device

Check if you’re still logged in on any device

![]() If you have access, move funds to a new wallet with a secure backup

If you have access, move funds to a new wallet with a secure backup

![]() If you have no access and no recovery phrase, recovery is often impossible

If you have no access and no recovery phrase, recovery is often impossible

![]() Custodial accounts may allow recovery via the provider

Custodial accounts may allow recovery via the provider

![]() Treat backup creation as part of wallet setup, not optional

Treat backup creation as part of wallet setup, not optional

In general, someone cannot steal your crypto with only your wallet address, because the address is designed to be shared so others can send you funds. The address is public information and does not grant spending rights. The ability to move funds requires the private key or the recovery phrase that can regenerate it. However, sharing your address can create privacy considerations because transactions linked to that address can be viewed publicly on block explorers. Scammers may also use public information to target you with phishing attempts. The real risk is usually not the address, it’s being tricked into revealing your recovery phrase or approving a malicious transaction.

![]() Wallet addresses are safe to share for receiving funds

Wallet addresses are safe to share for receiving funds

![]() Spending requires a private key or recovery phrase

Spending requires a private key or recovery phrase

![]() Address sharing can reduce privacy, transactions may be visible publicly

Address sharing can reduce privacy, transactions may be visible publicly

![]() Scammers may target you after seeing you engage in crypto

Scammers may target you after seeing you engage in crypto

![]() Never share recovery phrases or approve unknown requests

Never share recovery phrases or approve unknown requests

Fees depend on the blockchain network you are using, not just the wallet app itself. When you send crypto, you typically pay a network fee that compensates the network for processing and validating your transaction. On Bitcoin, fees relate to transaction data size and network demand. On smart contract networks, fees can vary based on congestion and the complexity of the transaction. Some wallets allow you to choose fee levels, balancing speed and cost. In some cases, exchanges add a withdrawal fee on top when you send from an exchange account. If you are moving funds between your own wallets, check current network conditions and consider sending at quieter times.

![]() Fees are network-based, not purely wallet-based

Fees are network-based, not purely wallet-based

![]() Congestion can raise fees, quieter periods can reduce them

Congestion can raise fees, quieter periods can reduce them

![]() wallets let you choose speed versus cost

wallets let you choose speed versus cost

![]() Exchanges may add withdrawal fees on top

Exchanges may add withdrawal fees on top

![]() Check fee previews before confirming

Check fee previews before confirming

Yes, many wallets can be used across multiple devices. With non-custodial wallets, you can restore the same wallet on another device using the recovery phrase, which regenerates the same keys and addresses. The convenience is obvious, but each additional device increases exposure, so only do this when you can secure every device properly. With custodial wallets, multi-device access works through logins, but you rely on the provider. If you use a hardware wallet, you can pair it with multiple computers or phones while keeping signing confined to the device, which helps maintain stronger security.

![]() Non-custodial wallets can be restored using the recovery phrase

Non-custodial wallets can be restored using the recovery phrase

![]() More devices can mean more risk, secure each one carefully

More devices can mean more risk, secure each one carefully

![]() Custodial wallets support multi-device logins but add platform risk

Custodial wallets support multi-device logins but add platform risk

![]() Hardware wallets can be used with multiple devices while keeping keys offline

Hardware wallets can be used with multiple devices while keeping keys offline

![]() Keep long-term holdings in cold storage and limit device spread

Keep long-term holdings in cold storage and limit device spread

If you suspect compromise, act quickly and assume the attacker may still have access. If you can still access the wallet, move remaining funds immediately to a new wallet created on a clean device, with a new recovery phrase stored offline. If your recovery phrase may have been exposed, treat the old wallet as permanently unsafe. Secure your environment by removing suspicious apps or extensions, scanning for malware, updating your device, and changing passwords for related accounts such as email. If the issue involves an exchange account, contact the provider and follow their process, but results vary. If you lost funds to a scam, keep records including transaction IDs and communications, and be cautious of anyone claiming they can recover funds for an upfront fee, as follow-on scams are common.

![]() Move remaining funds to a new wallet on a clean device

Move remaining funds to a new wallet on a clean device

![]() Treat a leaked recovery phrase as a full compromise risk

Treat a leaked recovery phrase as a full compromise risk

![]() Remove suspicious apps and extensions and update security settings

Remove suspicious apps and extensions and update security settings

![]() Secure your email and related accounts as well

Secure your email and related accounts as well

![]() Document evidence and avoid paid “recovery” scams

Document evidence and avoid paid “recovery” scams

Advertising with us puts your brand in front of a highly engaged crypto audience actively looking for exchanges, tools, and opportunities they can trust.

Discover top-rated crypto exchanges with expert news, honest reviews, exclusive promotions, and discounts, sign up to our newsletter to stay ahead of the game. – Always remember to Responsible Gambling

Top Rated Crypto Exchanges © 2024 2025 . All Rights Reserved. + 18+ Play responsibly. Offers subject to T&Cs. Check availability in your region.